7 Easy Facts About Ryan Lavergne Real Estate Shown

Table of ContentsFacts About Ryan Lavergne Real Estate RevealedRumored Buzz on Ryan Lavergne Real EstateHow Ryan Lavergne Real Estate can Save You Time, Stress, and Money.The Basic Principles Of Ryan Lavergne Real Estate

For comparison, Wealthfront's average profile gained just under 8% web of fees over the previous 8 years. And the Wealthfront return is far more tax reliable than the return you would receive on realty as a result of the way returns on your Wealthfront profile are strained and our tax-loss harvesting.1% return, you need to have a nose for the communities that are most likely to appreciate most rapidly and/or discover a horribly mispriced property to purchase (into which you can spend a tiny quantity of money as well as upgrade right into something that can regulate a much greater rental fee even better if you can do the work yourself, however you require to ensure you are being effectively made up for that time).

And also we're discussing individuals who have large staffs to assist them discover the ideal property and also make enhancements. It's far better to diversify your investments You need to consider spending in a private residential or commercial property similarly you should assume about an investment in a private supply: as a huge threat - ryan lavergne real estate.

The concept of attempting to select the "right" individual property is attractive, especially when you assume you can obtain a bargain or purchase it with a great deal of utilize. That strategy can work well in an up market. However, 2008 instructed all of us regarding the threats of an undiversified property profile, as well as reminded us that leverage can function both means.

Rumored Buzz on Ryan Lavergne Real Estate

Liquidity matters The last significant debate versus having financial investment buildings is liquidity. Unlike a property index fund, you can not sell your home whenever you want. It can be difficult to forecast exactly how lengthy it will certainly consider a household home to sell (and it frequently seems like the a lot more eager you are to offer, the longer it takes) (ryan lavergne real estate).

Attempting to make 3% to 5% more than you would on your index fund is almost impossible except for a handful of real estate private equity financiers who bring in the finest as well as the brightest to do just concentrate on outshining the marketplace (ryan lavergne real estate). Do you truly believe you can do it when experts can't? Our advice on rental property investing follows what we recommend on various other non-index investments like stock selecting as well as angel investing: if you're mosting likely to do it, treat it as your "funny money" and restrict it to 10% of your fluid net worth (as we describe in Measuring Your Home As An Investment, you should not treat your home as a financial investment, so you don't have to restrict your equity in it to 10% of your liquid net well worth).

However, if you own a residential or commercial property that rents for much less than your lugging cost, after that I would highly prompt you to take into consideration offering the residential property as well as instead invest in a varied portfolio of low-cost index funds.

Some people pick to purchase a home to lease out on a long-term basis, while others go for short-term leasings for visitors and company tourists. From homes, single-family residences, and also penthouses to commercial offices as well as retail areas, the city has a vast array of residential or commercial properties for budding financiers.

Ryan Lavergne Real Estate Fundamentals Explained

So, is Las Las vega actual estate an excellent financial investment? Let's check out! Why Las Vegas is an Excellent Location to Invest in Property, A great deal of people are relocating to Las Las vega whether it's due to the fact that of the amazing climate, no earnings taxes, and also an excellent expense of living. That's why the city is continuously becoming a leading realty financial investment destination.

Between the well known Strip, the abundance of resorts, resorts, as well as casinos, first-rate home entertainment, incredible interior attractions, and also fantastic exterior areas, individuals will constantly be drawn to the city. This suggests you're never except visitors trying to find a place to remain for a weekend trip, a lasting rental, or a residence to relocate to.

These bring in service vacationers and entrepreneurs from all walks of life who, once again, will certainly be looking for someplace to remain. Having an actual estate residential or commercial property in the area will be useful for them as well as visit this web-site make returns for you.

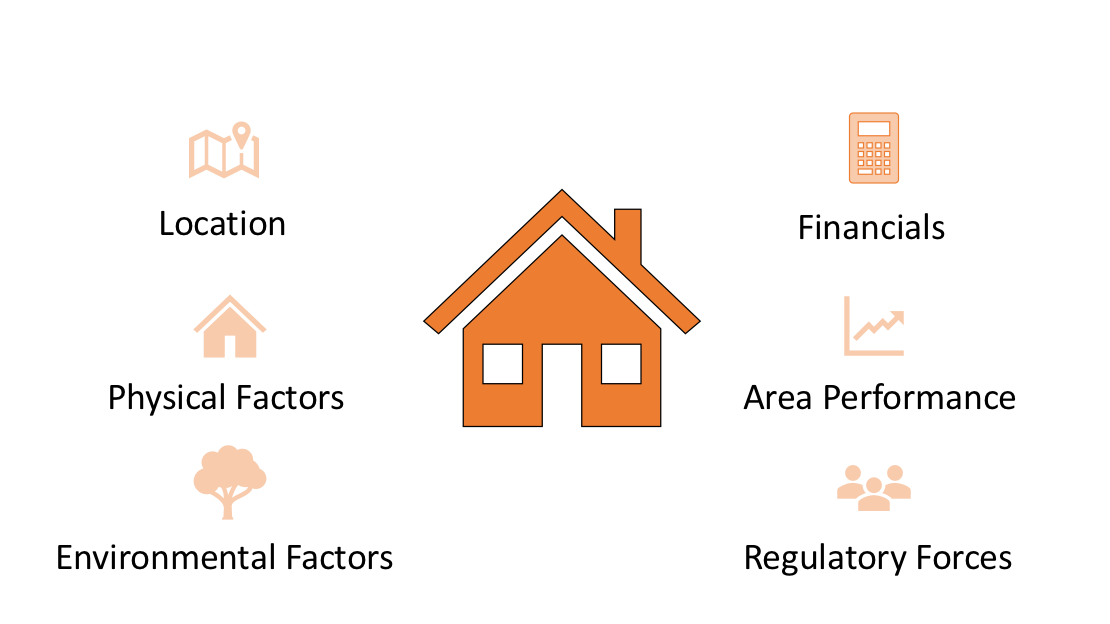

You can expect a consistent stream of people looking to lease out purchase, even your Las Vegas actual estate investment. What to Look for in a Good Financial Investment Home, Investing in genuine estate is a major life choice. To figure out if such an investment Full Report is great for you, make sure to consider these important factors.

Little Known Questions About Ryan Lavergne Real Estate.